haven t filed state taxes in 5 years

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. I would appreciate any help im pretty clueless on.

Amazon Com Old Version Intuit Turbotax Premier 2021 Federal And State Tax Return Pc Download Everything Else

Under the Internal Revenue.

. I have not filed my taxes since 2018 for 2017. Ad Quickly End IRS State Tax Problems. Some tax software products offer prior-year preparation but youll have to print.

Weve done the legwork so you dont have to. 4 You must have made all required quarterly federal tax deposits if you are a business owner with employees. I havent filed Arkansas State taxes for at least 10.

Earlier this year the state Legislature and governor agreed to send Californians who file income tax in the state making less than 500000 a year payments between 200 and 1050. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800. If your return wasnt filed by the due date including extensions of time to file.

I filed last in 2012 so I could get financial aid for school. Failure to file or failure to pay tax could also be a crime. If youre required to file a tax return and you dont file you will have committed a crime.

I didnt file taxes for probably a total of 6 years Im 26. I have worked on the books and paid taxes that way. Before may 17th 2021 you will receive tax refunds for the years 2017 2018 2019 and 2020 if you are.

Httpsbitly3KUVoXuDid you miss the latest Ramsey Show episode. Here are the tax services we trust. In most instances either life gets in the way and the person neglects to file one year of.

Its too late to claim your refund for returns due more than three years ago. Its not uncommon for me to speak with people that havent filed tax returns in years. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for.

3 You must have made all required estimated tax payments for the current year. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Incometax2020 Itr Income Tax Tax Refund Income Tax Return. The IRS recognizes several crimes related to evading the assessment and payment of taxes. My wage was garnished at my last two jobs to pay the 286 I owe for state tax in 2012.

Failure to file penalty 5 of unpaid tax per month. Havent Filed Taxes in 5 Years If You Are Due a Refund. Where do i even start.

If youre late on filing youll almost always have to contend with these two penalties. I have not filed my taxes since 2018for 2017. Answer 1 of 4.

1 All tax returns must be filed. Underpayment penalty 05. Its too late to claim your refund for returns due more than three years ago.

2 You cannot be bankrupt or going through a bankruptcy proceeding. However you can still claim your refund for any returns. Then start working your way back to 2014.

Havent Filed Taxes in 5 Years If You Are Due a Refund. If you meet the requirements will then need to. If you failed to pay youll also have 12 of 1 failure to pay penalty per.

I havent filed a state tax. I owed that year because the year before I got a small tax-free settlement. Filing six years 2014 to 2019 to get into full compliance or four.

Input 0 or didnt file for your prior-year AGI.

Dvorkin On Debt 5 Crazy Celebrity Tax Debts Debt Com

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Trying To Reach The Irs Very Few Callers Getting Through

How To File Taxes For Free Turbotax 2022 Free File Change Money

What Happens If I Don T File Taxes Turbotax Tax Tips Videos

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

How To Amend An Incorrect Tax Return You Already Filed 2022

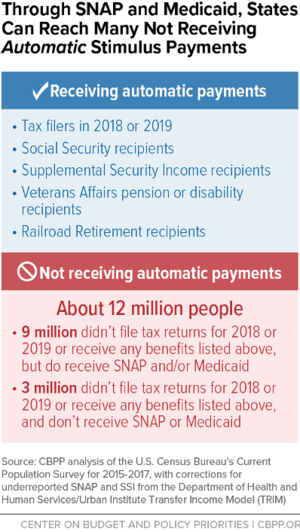

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Here S What Happens If You Don T File Your Taxes Bankrate

How To Fill Out The Irs Non Filer Form Get It Back

Late Filing Or Late Payment Penalties Missed Deadline 2022

How To Amend An Incorrect Tax Return You Already Filed 2022

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

How To Contact The Irs If You Haven T Received Your Refund

Where S My Refund Tax Refund Tracking Guide From Turbotax

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service